According to the latest report by IMARC Group, titled “Mobile Wallet Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033”, offers a comprehensive analysis of the industry, which comprises insights on the global mobile wallet market size. The report also includes competitor and regional analysis, and contemporary advancements in the global market.

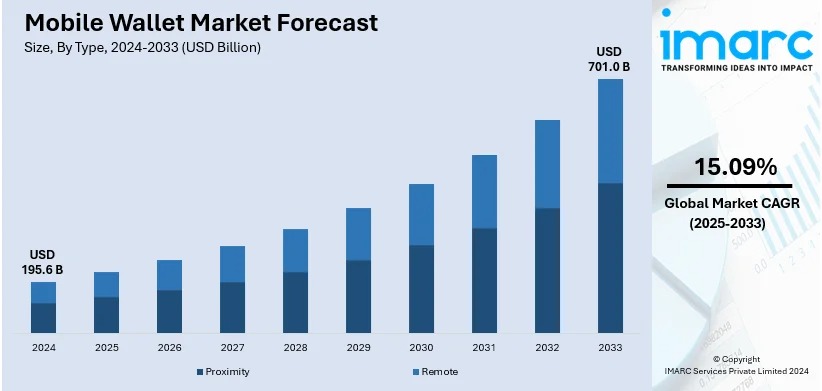

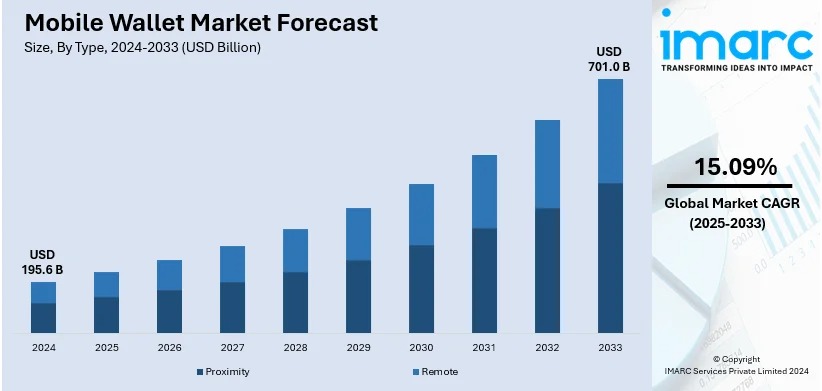

The global mobile wallet market size was valued at USD 195.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 701.0 Billion by 2033, exhibiting a CAGR of 15.09% from 2025-2033.

Request Free Sample Report: https://www.imarcgroup.com/mobile-wallet-market/requestsample

Mobile Wallet Market Dynamics:

Growing Smartphone Penetration and Use of the Internet:

The world mobile wallet market is witnessing strong growth, mainly led by the growing penetration of smartphones and use of internet services across the globe. As smartphones become more and more central to people's lives, customers are being driven towards the convenience and ease of mobile wallets for different financial transactions. The convenience of paying, transferring money, and managing finances using smartphones is a major market growth driver. In addition, the increasing penetration of low-cost smartphones and rising internet penetration in emerging economies are expanding the customer base for mobile wallet services, providing a strong support base for long-term market growth.

Increasing Adoption of Contactless Payment Technologies:

The worldwide trend towards contactless payment schemes is a major driver for the mobile wallet industry. In response to factors including the urge for speed and convenience in transactions as well as increased hygiene awareness, both consumers and merchants are moving towards contactless payment options. Mobile wallets, with the application of technologies such as Near-Field Communication (NFC) and QR codes, enable smooth and secure contactless payments at point-of-sale (POS) points. This increasing demand for contactless transactions is driving mobile wallet adoption as a first-point-of-payment method, further boosting market growth across several retail and service industries.

E-commerce and Online Transaction Expansion:

The burgeoning e-commerce market and the rapidly growing number of online transactions are greatly fueling the growth of the mobile wallet market. Mobile wallets are a safe and easy payment method for making online payments, saving time and effort from entering long card details for every transaction. Ease of integrating mobile wallets with e-commerce websites and increasing consumer inclination for mobile-first shopping experience are pushing mobile wallet usage for online payments. This collaboration of e-commerce and mobile wallets is building a robust ecosystem that powers market expansion and reinforces the broader digital payment environment.

By the IMARC Group, Some of the Top Competitive Landscape Operating in the Mobile Wallet Market are Given Below:

- Alipay.com (Alibaba Group Holding Limited)

- Amazon Web Services Inc. (Amazon.com Inc)

- American Express Company

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Mastercard Incorporated

- Paypal Holdings Inc.

- Samsung Electronics Co. Ltd.

- Squareup Pte. Ltd.

- Visa Inc.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/mobile-wallet-market

Global Mobile Wallet Market Trends:

The global mobile wallet market is characterized by several evolving trends that are shaping its future. A prominent trend is the increasing integration of value-added services beyond basic payment functionalities. Mobile wallet providers are incorporating features such as loyalty programs, digital coupons, bill payments, and peer-to-peer (P2P) transfers to enhance user engagement and stickiness. This expansion of service offerings transforms mobile wallets into comprehensive financial management tools, driving greater user adoption and transaction volumes.

Yet another important trend is the increased focus on interoperability and standardization across various mobile wallet platforms and payment networks. There are attempts being made to enable frictionless transactions between multiple mobile wallets and payment networks, making it more convenient for users and fostering greater acceptance. Additionally, there is more collaboration in the market between mobile wallet issuers, financial institutions, and merchants to develop a combined and seamless payment experience. The use of biometric identification technologies, like fingerprint and face recognition, is also picking up, adding strength and convenience to mobile wallet payments.

Key Market Segmentation:

Analysis by Type:

Analysis by Application:

- Retail

- Hospitality and Transportation

- Telecommunication

- Healthcare

- Others

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

Key highlights of the Report:

- Market Performance

- Market Outlook

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

SURVEY

How Did You Hear About Us?

SURVEY

How Did You Hear About Us?

Comments